Error message title

Error message title

Searching great energy plans for you

Media and News

Explore our articles and latest news.

ENGIE & Melbourne United Partnership

We’re super excited to become major sponsors of Melbourne United.

Sept 5, 2023

ENGIE and POSCO Holdings announce an important step towards a green steel industry in Australia

The project will supply green hydrogen to POSCO Group’s proposed Hot Briquetted Iron (HBI) plant

June 14, 2023

Historic Moment in Australia's Energy Transition as Hazelwood Battery Energy Storage System is Commissioned

Jul 19, 2023

ENGIE AMEA Sustainability Report 2023 Released

We are pleased to announce the publication of our third Sustainability Report...

June 14, 2023

Infrastructure planning to begin at Hills of Gold Wind Farm

ENGIE Australia & New Zealand today announced the appointment of a preferred partner...

Sep 16, 2022

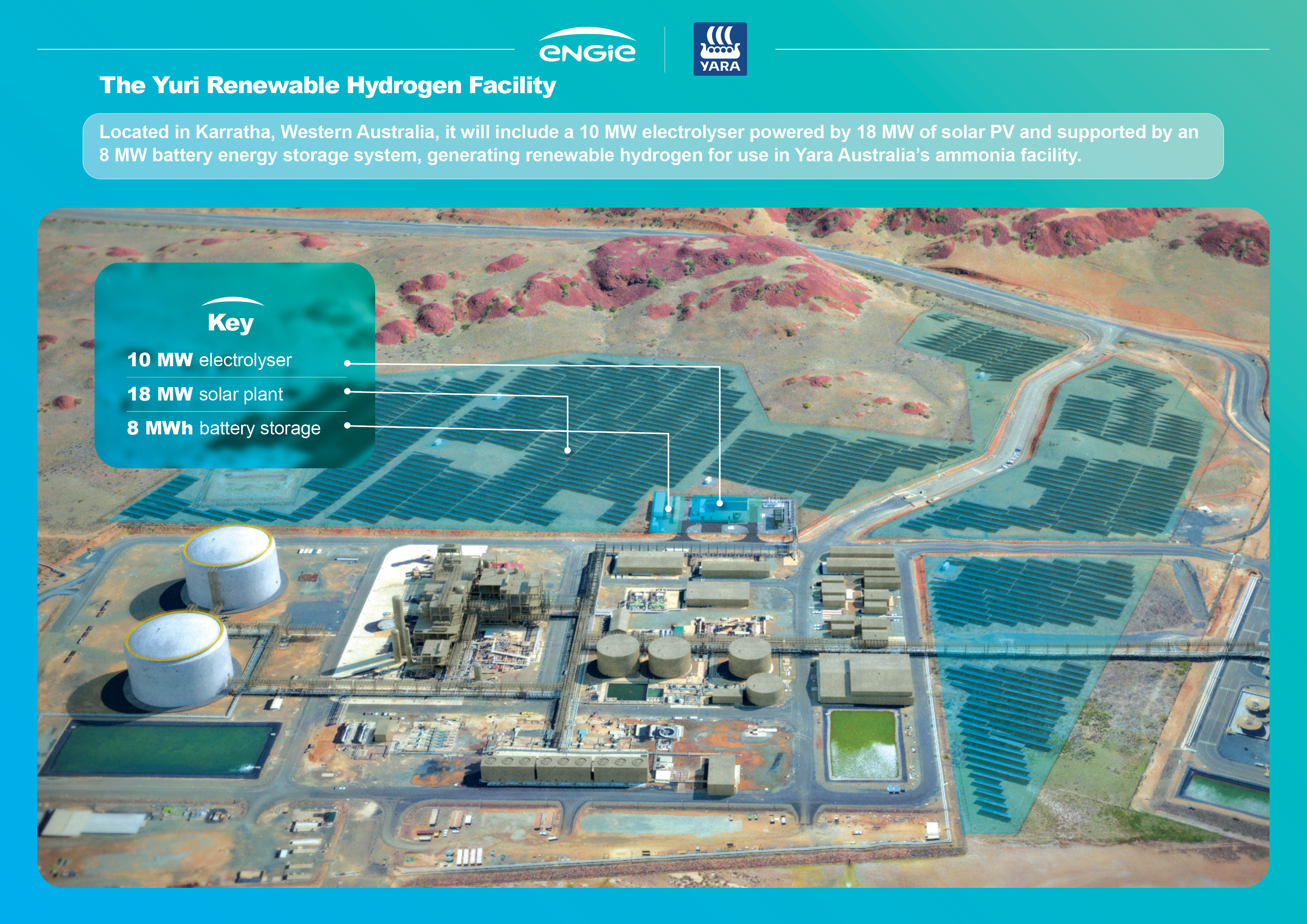

ENGIE reaches important milestone in Australian renewable hydrogen project with Yara

ENGIE has taken Final Investment Decision in the development...

Aug 03, 2022

Charter Hall signs long-term renewable energy supply agreement with ENGIE

Charter Hall Group (Charter Hall or the Group) is pleased to announce...

Media Enquiries

Please contact us at 0488 701 339 or via email at [email protected]